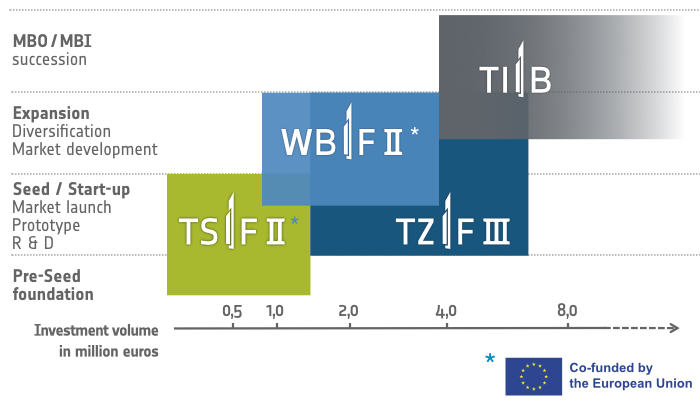

Funds – Purpose & Investment amounts

Funds in detail

Thüringer Zukunftsfonds III (TZF III)

- € 35 million fund assets€ 37,5 million fund assets€ 37,5 million fund assets

- Companies of any size and age

- Repayment or Exit via IPO, trade sale, or MBO/MBI

- Capital provided by the ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation) and KfW

- Minority equity stakes, silent partnerships and loans up to € 7.000,000; preferably with a private co-investment

- The focus is on Thuringian start-ups that pursue ecological, digital or social innovations in particular, as well as medium-sized companies from Thuringia on an innovation and growth path. With this target group, the Thuringian Future Fund III also supports the growth and impact of social innovations and public welfare-oriented companies and thus contributes to the implementation of the “National Strategy for the Promotion of Social Innovations and Public Welfare-oriented Companies”

Thüringer Startup-Fonds II (TSF II)

- Launched on December 15, 2022

- € 30 million fund assets

- young innovative small companies (max. 5 years old)

- 5–10 years duration

- Exit through IPO, trade sale or MBO/MBI

- Capital provided by the ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation) and the EFRE (European Regional Development Fund) in the start-up phase

- Proportionate corporate financing in the start-up phase

- Open minority investments up to € 1,500,000 possible; co-investment of private investors desired

- In addition to strengthening the resilience of Thuringia’s economy and the necessary transformation of existing structures, the fund also aims to contribute to current societal challenges, such as advancing decarbonization and promoting greater sustainability.

TSF II Investment Guidelines – in German (PDF)

![]()

Thüringer WachstumsBeteiligungsFonds II (WBF II)

- Launched on December 15, 2022

- € 25 million fund assets

- innovative small and medium-sized companies in growth phase (max. 8 years old)

- 5–10 years duration

- Exit through IPO, trade sale or MBO/MBI

- KapitCapital from the Free State of Thuringia and the ERDF fund (European Regional Development Fund)

- Open minority investments up to € 4,000,000 possible; max. however in the same amount as co-investment of private investors

- Proportionate growth financing for further development of products and services and for opening up new markets

- In addition to strengthening the resilience of Thuringia’s economy and the necessary transformation of existing structures, the fund also aims to contribute to current societal challenges, such as advancing decarbonization and promoting greater sustainability.

WBF II Investment Guidelines (PDF)

![]()

Thuringia Industry Investments GmbH & Co. KG (TIB)

- Launched on December 4, 1993

- €102.0 million fund assets

- Industrial companies with above average growth potential; not limited to SMEs

- 3–7 year investment horizon

- Exit through IPO, trade sale or MBO/MBI

- Capital provided by the Free State of Thuringia, ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation)

- Growth financing and investments around management succession (MBO/MBI)

- Buy-out of minority stakes for investments over €5.0 million; can act as sole investor or as the lead of a consortium of co-investors>

Thüringer Zukunftsfonds (TZF fully invested)

- €20 million fund assets

- Companies of any size with future potential that are negatively affected by the Covid19 pandemic

- Repayment or Exit via IPO, trade sale, or MBO/MBI

- Capital provided by the Free State of Thuringia, ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation)

- Minority equity stakes, silent partnerships and loans up to € 5.000,000; preferably with a private co-investment

- Financing for companies in the State of Thurigia that are negatively effected by the Covid19 crisis but show potential for future growth

Thüringer Zukunftsfonds II (TZF II fully invested)

- €16 million fund assets€ 37,5 million fund assets€ 37,5 million fund assets

- Companies of any size with future potential that are negatively affected by the Covid19 pandemic

- Repayment or Exit via IPO, trade sale, or MBO/MBI

- Capital provided by the Free State of Thuringia, ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation)

- Minority equity stakes, silent partnerships and loans up to € 1.800,000; preferably with a private co-investment

- Financing for companies in the State of Thurigia that are negatively effected by the Covid19 crisis but show potential for future growth

Thüringer Start-up-Fonds (TSF fully invested)

- Launched on November 9, 2015

- €28.75 million fund assets

- Young, innovative companies (max. 5 years old)

- 5–10 years duration

- Exit through IPO, trade sale or MBO/MBI

- Capital provided by the ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation) and the EFRE (European Regional Development Fund) in the start-up phase

- Proportionate corporate financing in the start-up phase

- Minority equity stakes up to €1.2 million; preferably with a private co-investment.

- The aim of the fund is to achieve two output indicators from the “Operational Program Thuringia ERDF 2014 — 2020”. As part of investment priority 3a (promoting entrepreneurship), it is planned for the TSF to support 30 companies in the start-up phase by 2023 and — together with the “Thuringian Growth Participation Fund” (WBF) — to create 250 full-time equivalent jobs in Thuringia by 2023.

Thüringer WachstumsBeteiligungsFonds (WBF fully invested)

- Launched on November 9, 2015

- €27.5 million fund assets

- Innovative growth companies (max. 8 years old)

- 5–10 years duration

- Exit through IPO, trade sale or MBO/MBI

- KapitCapital from the Free State of Thuringia and the ERDF fund (European Regional Development Fund)

- Open minority investments up to € 4,000,000 possible; max. however in the same amount as co-investment of private investors

- Proportionate growth financing for further development of products and services and for opening up new markets

- The aim of the fund is to achieve two output indicators from the “Operational Program Thuringia ERDF 2014 — 2020”. As part of investment priority 3a (promoting entrepreneurship), the WBF plans to support 20 companies in the growth phase by 2023 and — together with the “Thuringian Start-up Fund” (TSF) — to create 250 full-time equivalent jobs in Thuringia by 2023.

MFT Mittelstands-Fonds Thüringen GmbH & Co. KG (MFT fully invested)

- Launched on December 1, 2015

- €40.0 million fund assets

- Established and profitable small- and medium-sized companies (min. revenue €2.0 million)

- 5–10 years duration

- Exit through IPO, trade sale or MBO/MBI

- Capital provided by the Free State of Thuringia and private institutional investors

- Financing of company growth, expansion to new markets and company succession plans (MBO/MBI)

- Equity stakes and silent partnerships up to €5.0 million

Thüringer Gründerfonds (ThGF fully invested)

- Launched on March 29, 2011

- ~ €10.0 million fund assets

- Young, innovative companies

- Capital provided by the Free State of Thuringia, ThüB (Stiftung Thüringer Beteiligungskapital, translation: Thuringian Investment Capital Foundation)

- Proportionate corporate financing in the start-up phase

- fully financed; no new investments

Private Equity Thüringen GmbH & Co. KG (PET fully invested)

- Launched on June 30, 2005

- €70.85 million fund size

- Industrial companies with above-average growth potential, SMEs

Capital from the Free State of Thuringia and private and public institutional investors - Proportionate corporate financing in the start-up and growth phases

- fully financed, no new investments

![]()

Private Equity Thüringen GmbH & Co. Zweite Beteiligungen KG (PET II fully invested)

- Launched on May 26, 2010

- €40.0 million fund size

- Young technology-focused companies, SMEs

- Capital provided by the Free State of Thuringia and private institutional investors

- Financing in the start-up and growth phases, including in conjunction with management succession

- fully financed, no new investments

Funds & volumes

Open participation

- Amount: 100,000 €-10,000,000 €

- Exit after 3–7 years

- Standard industry valuation (max. 49.9%)

- Young and already established, fast-growing

companies

Silent partnership (mezzanine)

- Amount: 100,000 €-5,000,000 €

- up to 10 years

- Interest in line with the market

- Established companies with stable cash flows

Investment Process

Time scope

Generally, the entire investment process, from the first contact with bm|t to signing the investment contract, takes approximately 3–6 months.

Business Plan

In order to assess whether a venture fits our investment criteria and investment focus, we need an investment summary or detailed business plan accompanying an investment inquiry.

Funding Strategy

If the venture passes our first assessment, we will invite the management team to present their business model and strategy to bm|t. In the subsequent discussions, the general conditions of a potential financing round and bm|t investment are reviewed with the entrepreneurs..

Term Sheet or Letter of Intent

If the investment team decides a potential investment is worth pursuing further, we will provide a Term Sheet or Letter of Intent that outlines the terms of a potential bm|t investment.

Due Diligence

In the subsequent due diligence process, we determine the legal, economic, financial and technical circumstances of your company in detail.

Investment Agreement

If the due diligence process has a positive outcome, we will then prepare and negotiate an Investment Agreement.

Investment Committee

Before signing the Investment Agreement, bm|t’s investment committee, which includes external experts, will make a final decision concerning the investment.

Contract Conclusion

Payout

After signing the investment agreement, the investment will be paid out according to negotiated milestones.